AMA Summary Nov 30, 2022

Dec 20, 2022 • 15 min read

Tenderize Liquid Staking

“Redefining liquid staking”

Salim - Tenderize COO: Introduction

I have been an entrepreneur for 10 years. Last year I decided to go all in on web 3, not only as investing but in working on it, so here I am joining Tenderize as chief operating officer. My responsibilities are business development and leading the daily operation.

What is Tenderize?

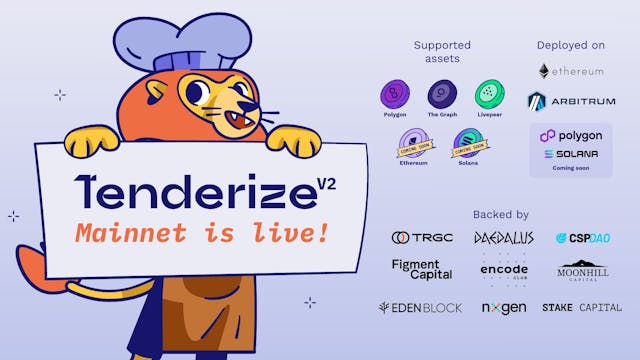

Tenderize is a liquid staking protocol, it's not a derivative platform but we create the possibility for tokenized stake and what we are doing with Tenderize is we are going beyond liquid staking and also focusing on the use cases for these tokenized stake. Tenderize went live this year and currently we support for projects Livepeer, Polygon, The Graph, and Audius.

So this is our liquid staking that's already live and we are planning to launch our version 2. We plan also to release our whitepaper soon, so stay tuned to that because it's really exciting.

What is your view of Liquid Staking ecosystems as it stands today just in general?

It has great potential when we look at the stake in the staking market now. Staking market is an industry of 50 billion and only 10% uses liquid staking. We believe that’s because liquid staking is only built for the delegators at the moment. When it comes to the node operators that are on the networks that don’t have real use to it, they are the long term people that are in the network supporting it, securing it, and doing productive work, and we believe that liquids taking should also have good use cases. What we want to do is actually help them by creating use cases in our system.

NICO - Tenderize Founder: Introduction

My name is Nico. I'm the founder of Tenderize, day to day I do the CTO stuff leading the technical and research areas of the project. Before that I spent nearly 3 years working with Livepeer, doing smart contract works and working on the protocol, from there I got my feel very early on in 2019 with staking and web3 middleware protocol like the Graph that we support.

So that’s the background I came on and that's quickly translated into Tenderize when around 2020 , we saw in the livepeer community the question pop up about could we have like a yearn finance vault for lpt staking like that and that time became its own protocol that became Tenderise.

What are some of the major hurdles that projects like yours have to overcome in the tokenized liquid staking world?

- Regulatory.

I think there has definitely been a lot of regulatory concern lately. Not only liquid staked assets, but also whether staking itself, whether, how that should be classified regulatory speaking. And then if you add another layer of liquid staking on top of that it becomes even more complex. So especially from some larger players in the industry, we've seen more risk approaches when it comes to regulatory risk.

- Transferring from Traditional staking to liquid staking.

The other one is that, I think ETH was kind of in a special position when stake Eth (POS) launched for that or when liquid staking is launch because, prior to those projects launching, there was no staking for it. They launched at the same time or roughly around the same time as staking on the Beacon Chain launched itself.

But for projects like Polygon like Liquid staking came after the network launched. So what we see is that a lot of this stake a lot of the users that hold stakes want to transfer to liquid staking but their stake is already locked and if they would then want to transition to a liquid staking protocol there is that opportunity there and you could provide benefits for them.

But there is also a cost to switching to a liquid staking protocol in most cases and they would have to unstake from their current position, wait for the unbonding period and then restate through the liquid staking protocol which is kind of a high barrier of entry and I think that's something that we've been struggling with, a little bit to make that process easier, and I imagine it's true for other liquids taking protocols as well.

What type of liquid stake assets Tenderize currently supports ?

We currently support Matic,livepeer, the graph and audios. We are looking into other networks within our scope which is mostly Web 3 infra, and L2 so definitely looking at projects like Chainlink, have been talking about its staking, Gelato network as well, all projects in sort of that in middleware and all L2.

We are not looking into the L1 at the moment, our philosophy is that if you build a web 3 dapp you would use a lot of these middleware or computing protocols, something like storage for storing data, the graph for indexing, livepeer to do video. These protocols work together but you only settle the transaction on one layer1 or one settlement layer, that's why we choose to support the middleware protocols first and nobody is doing it as well.

Why don't you have Eth liquid staking even though it is the most liquid and has the highest demand?

When we know there were other people or other established projects working in Eth like rocket protocol has been around for quite a while, we felt like okay there are people solving the problem for Eth liquid staking which is on its own quite specific staking system, like there's very little count of people would have the 32 Eth, having no delegation. So it requires a lot of specific codes just to support its staking. We felt like the market for Eth is a little bit saturated so it kind of made sense for us to do it for these other projects and we do feel that these middleware protocols are quite under looked as well. We've had the big defi boom, we've had the big Nft boom but if you look at it under the hood none of those applications would be able to exist in a decentralized way without that middleware layer without like decentralized storage or like data indexing by the graph. So we looked at the space as a whole and we want to help it grow as well.

Staking has many meanings today. Is that in your roadmap to do the escrow butter staking like curve or balancer yield or liquidity farming staking kind?

No, it’s not on the roadmap. I think the terms taking kind of lost a little bit throughout the years whereby what the project you just mentioned kind of came up to the terms to the staking, and recently you also often heard the term staking used in the same context that's like liquidity providing or liquidity farming.

For us staking means locking up tokens to a network where nodes perform some kind of useful work and there is revenue being generated by that work and that gets shared by this stakers and the people running the network, that's staking by definition for us, so very much in that proof of stake or middleware with staking on top of it context not really the liquidity pool kind of staking.

In the projects that you support today, which have many hurdles the most? matic,livepeer, graph, audios?

From an implementation standpoint, because we operate on the delegation market, Tenderize delegates to node operators, so each of the networks we support does have that capacity of delegation to delegate tokens, but they are implemented in very different ways. I think the one I actually think is the most complete is matic very similar to livepeer in some regards as well but it does have slashing in it. And what I also think is cool about Polygon is that very early in the roadmap they wanted to have something like liquid staking, if you go into the documentation you can still read about validator shares and i think the initial id very early on what's to have them be transferable they are not transferable right now your kind of just represent your steak but they kind of gave the the initial approach to liquid stake.

The one we've had the most hurdle with would be the graph and audios simply by the way they implement unstaking, which we kind of have to build a work around that, but other than that they are quite similar. One project looks at the other when they write their own unstaking specifications for their own staking system, like for example Polygon adapted the same way of unstaking as it was in livepeer after Polygon was already live through an upgrade. So people look around what's working for other teams and try to implement that as well. So I think what will end up maybe in a few years is actually a more standardized way that protocols implement staking which could also benefit liquids taking protocols more easily or to yet better integrate them and faster. So currently the graph and audios but purely from a technical implementation standpoint.

How do you handle slashing? What are the general risks involved in tokenize, liquid staking?

Yes. So we don't really try to alter any of the risks or rewards in the underlying protocol. So if there is slashing in the underlying protocol that can also happen in Tenderize and that loss can get socialized among all of the people holding that liquid state assets. What we have seen in practices in the networks we support there has been no slashing to date. So that's kind of interesting. Even though they have been live for a long time like Polygon have been live for quite a while. The Graph has also been alive for over a year now and there have been no slashing incidents. But we do not try to mitigate that risk in any way? Like both rewards and losses are socialized among holders, just that's like it would be in the underlying protocol. Like I said, we do Operate on delegation markets and some protocols only slash the node operator and not the delegators, some slash both. It kind of also depends on the protocol.

I Think for now, Matic and the audios are the only ones whereby Delegators can also get slashed. But if you look at the stake of others for example, the same risk exists there even nodes from the lido pool get slashed, that loss also gets propagated to stake eth holders.

With the next version of the protocol that we're building, we are just trying to be a layer on top of this staking that already exists without altering workflows or mechanics. We think that quite important, because otherwise it might lead to unexpected or unwanted outcomes for the underlying network if you take a big control of a big portion of the steak like we've seen with Lido and the concerns around that so that's kind of our approach and and like a quick intro to the practical risks that currently exist within tenderize when it comes to slashing.

I don't see a big team working and a big market for this project like the graph, audios and livepeer. What is the benefit for users staking into this platform?

Good Question. Our primary focus with what we have and for the next version is the existing node operators and their delegator with lock tokens, and what we want to achieve is allow these node operators and delgators to also gain the benefits of liquids taking. We've seen a bit of defi integrations for stake eth, but yeah like you said we haven't really seen it from these networks we support simply because, they didn't really have defi integrations going before and most of the supply is only locked in staking. So we kind of have to bootstrap that from the ground up still and that's kind of what our mission or vision is to create these markets and these integrations for these projects.

Validators, node operators, delegators on these networks, do have a need for better capital efficiency.

I'm a node operator on the livepeer network myself. I run sort of very similar to a mining pool. You connect your GPU, you process some video or some live streams and you get paid in eth. It's a hobby project, but has grown quite a bit and it's actually a prominent project in the livepeer through community and I'd like to grow it more, but it just doesn't have the financial resources available to really do that. But if I was able to like tokenize my steak as a node operator without having to share it with other nodes on the network, having to share my rewards with like a pool of node operators, I can then fully capitalize On my operation, my cash flows and my principal and really use Tokenize stake as a way to to unlock that and hire people, get better servers for example. Even if I want to start a new node, if I have to put up stake and hardware, I can put up the stake, collateralise it and purchase the hardware to kickstart my operation, which would also greatly reduce the barrier of entry for node operators. So that's kind of a goal here.

That's why we want to create these markets so that we create a level playing field for node operators to grow in scale, which in turn also helps growth and decentralization of those underlying networks.

What else do you think polygon and tenderize can do to further grow the tokenize liquid staking ecosystem in polygon?

The bridging stuff is definitely a hurdle we've been thinking about, most users indeed, hold matic tokens on sidechain and not on mainnet, but the staking contracts are mainet. We've done a hack in September in Berlin whereby we try to create a generic bridge for elastic supply tokens which are liquid stake assets which would allow that to happen seamlessly through an easy user experience. I think the other big thing if you currently look at the data, If you look at the amount of stake that's in liquid staking protocols and how much stake there is total in Matic, It's less than 10%. I know if you know if you take the whole stake in the market with eth and all in it and then liquids staking protocols it's around 10% but if you discount Eth it's only around like 6 or 7%.

So what we see is that those liquid staking protocols only have a minority of the stake in it despite creating a lot of benefits and use cases. So we've started thinking okay, why is it like this low of a percentage and one part is like I already explained earlier, a lot of the stake is already locked and having to move into a liquid stake in protocol means losing out on rewards for a small period of time.

But the other part is that in models or designs they can't use, they can't put their own stake in a liquid stake. A set of validators on that network there rewards and losses would as well. And stake is actually your most important resource because it indicates how much work you can get or index how much revenue you can make. Would you kind of not really want to share your revenue with your competition rights? And this is true All setups no matter how you look at it, whether it's like livepeer which directly looks at how much stake you have ann with that stake you get at selection of node operators or whether it's eth whereby you have a lot of you have like multiple nodes with 32 eth each allocated to it. And the more nodes you have the bigger ownership of nodes on the network you have and the more chance you have to be elected as a leader. So in all of these networks like your stake indicates your revenue

And we actually think that's why there is so little stake in liquid stake and protocols because whoever owns most of the stake, it's likely going to be the main validators and the delegators that are specifically delegated to them,which might be like institutional delegators with contract obligations. So once we can serve those user types I think we can actually see an increase in liquid staking because we can finally serve the most important stakeholders of these networks and also allow them to use liquid staking.

From the Polygon proof mistake standpoint, I think the 4 major players in the tokenize, liquid stake in ecosystem would be Lido, ankr, strader and tenderize.

And I'm curious as to in your mind like how does tenderize differentiate itself from those other 3 players in the space?

Ankr is kind of a white label solution. They allocate your stake towards their node operation because their primary business is actually running RPC services, so they run a lot of validators. They allocate your stake to that. So it's really like an ankr specific liquid stake asset. Lido and strader are very similar in the sense that they are a kind of a yield aggregator. You put your tokens in and they get allocated to like a pool of validators and rewards and losses are shared among that. Our current version, what is currently live, is very similar to that model. But what we are building next then what we're going to launch in and hopefully Q1 of 2023 it is radically different.

We are to build staking as if it were native to Polygon. So each validator on the network kind of be able to have its own liquid stake token and that allows them basically to have their own white label liquid stake solution as well. They can direct their Delegators to their own liquid stake token and vault and then have people use that. And we have created a system whereby liquidity is kind of efficiently shared between all of these different tokens for each validator.

Without leading to centralize effects on the network. In this case for polygons only allocates stake to a small subset of validators you kind of, can lead to centralization. in like that set, cause I think for example lido on eth currently has 29 validators, but like there's that's only a very small subset of all the validators on the Ethereum network.

We think that a liquid staking protocol should be as neutral as possible and not to centralize or at least concerns over it and just act as a proxy that its utility withoutaffect like changes to work flows or or what not. So that's kind of how we differ there if that answers the question.

So nico what is in your mind? Something just the misconceptions about tokenize liquids staking?

And just like some misconceptions about Tenderise as well that you continually have to address and you can just address it now.

About tenderiser I guess the biggest misconception is that we do get always compared to Lido a lot. So allowing us to explain always helps with that. Like people always call us like long tail lido cause we support like the long tail end of the market. And we do currently have a similar design, but we realized that to move liquid staking and that the underlying networks that we support forward as a whole we need to do something better and we need to include validators.

That's kind of the thing on tenderize and what we struggle with most with liquid stake tokens misconceptions.

Also mostly questions around the regulatory status, especially when we are in the early days of tenderize when we still call liquid staking derivatives, like this always kind of scares people a little. So we put some effort into changing the language that we use. Also we commissioned a legal analysis of our liquid stake tokens to comfort people and make sure that they are not like securities or anything like that. So there are probably the 2 biggest things from a non technical perspective.

If some sayLiquid staking kind of defeats the mechanical technical and intended purposes of staking. How would you steal that argument ?

It's a good point and in this case, to provide some more contacts we are talking about that liquids staking would allow you to skip the unbonding period of the network in one unstake when you acted maliciously. So you would be able to exit your position without being penalized and I think that's a valid concern.

Currently on the delegation markets that we operate it's a little bit less of an issue because it's not the node operators stake directly.

And we also when slashing occurs like this the stake doesn't get unstake from the system it remains there, it still gets slashed but it might change hands like the risk might be transferred over to another person. But we were looking at node operators and were definitely looking at ways that we can mitigate that malicious behavior like they can exit or would be able to execute you like liquid staking and exiting their positions.

One example of that could be like a small insurance fund whereby a portion of the node operators' reward and principle are actually used as an insurance fund to payout to delegators through tenderize in case they get a slash, that can be like a potential way to mitigate that issue. But in All in all I think it's like a little bit of a trade off between.

Stop trying to alter that mechanic too much, but also allow people to get more utility from stake assets and lower the barrier of entries for these networks which are quite high as we've seen from a lot of conversations that we've had.

I also think as liquids taking designs improve that we like I said try to be more neutral and not interfere with mechanics of the underlying networks. But yeah, I think it's a very good question.

With the Terra Luna, FTX issue, how would you answer concerns like this?

I think what is important first and foremost is for any liquids staking be non custodial so that like a human can't miss purpose user funds right? And with that Terra Luna thing it was unfortunate, not really well thought out design kind of token economics that was pointed out by quite a few people before hand. Like the FTX yield by itself wasn't a sustainable thing.

But as I also pointed out with the networks we support, yield comes from actual production, people doing work with their computers. So to yield these networks is much more, much more sustainable.

So I think, I think these are kind of 2 important things to you to highlight as well like we cant re purpose stakers fund, like to tenderize protocol any user funds that thats in there, we can't like re purpose them for like investing it into like defi lending markets or what not.

So, its stake in the underlying protocol just as if you would stake it yourself and we can't really alter that.

Closing words: Nico

Yes. So like I talked about during the call, we are building the next version of the protocol with validators and their delegators in mind, us first Class citizens. So if you're a validator on the Polygon network or you're currently delegated to one of the validators or multiple, would love to hear from you. We are setting up a lunch partner program for V2.

In which Will will provide you more contact. You will be able to checkout to testnet, play a little bit around with liquid stake for your own validator there.

Yeah, I'm moving this forward where you can find more about. The project is tenderize.me and you can feel free to join our discord, follow us on Twitter. The Twitter account is in the Twitter space. We got a couple of cool announcements coming up in the next few weeks and more details about the next version of the protocol will be released as well.

If you want to know more about me, you can follow me on Twitter. I also have a LinkedIn you can find me on there as well.

If you want to chat, feel free to reach out to me. Like I said on discord or on Twitter, always happy to talk about staking or liquid staking.

Alpha in your inbox,

Subscribe now!

Subscribe to our newsletter and receive exclusive insights and be the first to know about new releases.

We will never spam you.