How will the Ethereum Merge impact Tokenized Stake?

Sep 23, 2022 • 3 min read

Ethereum completed the long-awaited Merge, enabling investors to stake ETH for rewards and opening a new era for the network. How does Ethereum shifting to a Proof-of-Stake (PoS) consensus impact tokenized stake? How is it related to the utility of staked assets for Web 3 infrastructure? Let’s explore.

The Ethereum Merge: A new consensus amid a roadmap for scalability

Ethereum just completed its official shift to a Proof-of-Stake consensus on September 15, bringing an entirely new approach to the 2nd largest network in crypto.

The Merge - the first of more areas of the Ethereum roadmap - reduces the energy consumption of the Ethereum network, one of its major critiques by outsiders, while shifting the dynamics in supply, making ETH a quasi-deflationary asset.

Recent estimations point out that the Ethereum Merge can reduce its energy consumption by 99%, while other researchers highlight that the global electricity consumption can lower by 0.2% with this event.

The roadmap for Ethereum is long after the Merge, with other phases such as the “Surge,” “Verge,” or “Purge,” bringing more scalability to the network, eliminating data redundancies and congestion, improving gas fees, and more.

Why is the evolution of Ethereum important?

Ethereum has been the backbone of the decentralized revolution, leading to the emergence of Decentralized Finance and the adoption of DApps and NFTs, among many other use-cases in crypto.

Despite the appearance of many alternative Layer 1 networks, Ethereum remains the de facto propeller of the decentralized economy, with many complementary solutions like Layer 2 building upon its growth potential.

Naturally, the evolution of this network and the opportunities it opens for the development of crypto and the investment landscape is crucial for the industry.

Ethereum staking: A new myriad of options for investors

With the Merge, investors can diversify their ETH holdings by staking it and earning rewards. Currently, over 11% of the Ethereum supply is staked across vehicles, offering, on average, a 4.8% APR.

Investors wanting to stake ETH can do it natively if they have the expertise, hardware, and capital (32 ETH) or delegate the node operations to another party.

Alternatively, investors can stake any amount of ETH through third parties like centralized exchanges or pool stakers (e.g., liquid staking), offering more flexibility. Around $8.1 billion of ETH is currently staked through liquid staking platforms like Lido, representing 30% of the total ETH staked.

Why are so many investors looking for liquid staking solutions with an asset like ETH?

Even though some current popular liquid staking platforms for Ethereum present a set of challenges (e.g., single points of failure, lack of automation in the protocols, few use cases beyond staking), investors are still attracted to the possibility of increased flexibility offered by the same tools.

Even with such a popular asset as ETH, ordinary investors still find challenges in diversifying and optimizing their capital allocation within a crypto environment. Some may not have 32 ETH available to stake, while others may want to diversify with a lower amount of ETH or desire to unlock more utility from their staked ETH.

The flexibility and decentralization mantra of crypto is yet to be fulfilled even when considering investments with the largest assets like ETH.

Despite those challenges, the interest is here, with billions staked in flexible and non-flexible options. Investors deserve better. Can you imagine the scenario with newer trends like Web 3?

What does the Ethereum Merge prove for Web 3?

The Ethereum Merge proves the mainstream interest in staking crypto assets, a new form of earning interest in a diversified crypto environment but also proves the dire need for flexible solutions to do so.

Holders of tokens from Web 3 infrastructure providers have even more difficulties in diversifying their investments and achieving capital optimization in a crypto environment.

Investors who do not have the technical expertise to allocate their holdings to the best-performing nodes of a provider will have very few ways to support Web 3 infrastructure while earning rewards from staking.

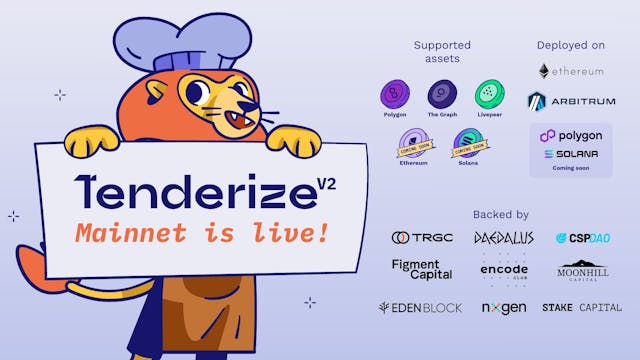

Meanwhile, Web 3 token holders with technical expertise will not find an easy or optimized experience for their token delegation with many opportunity costs. A solution like Tenderize is needed, where tokenized stake meets the full utility of staked assets.

Beyond the flexibility of tokenized stake, investors need to tap into other opportunities (e.g., DeFi) while earning rewards from staking and unlocking the full potential of their staked tokens.

Join us in the mission of boosting the use cases of staked tokens in a Web 3 environment.

Alpha in your inbox,

Subscribe now!

Subscribe to our newsletter and receive exclusive insights and be the first to know about new releases.

We will never spam you.