Liquid Staking With Tenderize Tutorial

May 13, 2022 • 6 min read

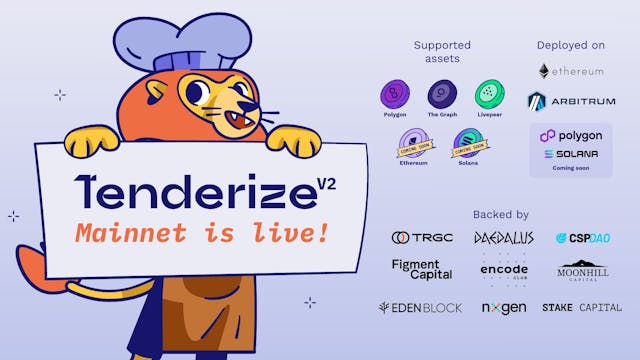

Staking meets flexibility in a new crypto-based derivatives world. That’s Tenderize in a nutshell.

With Tenderize, you can stake your crypto in a flexible model, earn staking rewards as TenderTokens, and still utilize your capital in DeFi to benefit from multiple use-cases.

Tenderize is built for individuals and Web 3 protocols who want to maximize their holdings and efficiently allocate capital across DeFi to supercharge their earnings.

Why is Tenderize special?

Tenderize has the best of both worlds: an easy-to-use and friendly platform that allows for automatic staking rewards with no lock-up periods.

With Tenderize, you stake your crypto holdings for an attractive APY, automatically compound staking rewards in TenderTokens, and enjoy 0-day lock-ups.

Tenderize makes this possible by issuing ERC-20-based derivatives, TenderTokens, which are pegged 1:1 to your staked assets. With derivatives, you can still enjoy staking rewards while having full flexibility to expand your crypto opportunities by providing liquidity or yield farming.

Additionally, you can swap back your earned TenderTokens for the original crypto asset you staked without the need for withdrawal periods.

Ready to experience the new wave of derivatives protocols offering more use-cases? Let’s look at everything you can do with the Tenderize app.

- Staking on Tenderize

What is staking?

Think of staking like a supercharged crypto-based interest account.

By staking your original crypto (e.g. GRT) through Tenderize, you can start earning rewards proportionally to the staked amount, doing no extra work. Beyond the potential appreciation of the staked asset, you will also passively earn staking rewards..

Why is that? Staking crypto also benefits Web 3 protocols in terms of security and being able to provide valuable work, such as confirming transactions, heavy computation or storing data.. As a result, you share in the revenue of the protocol and any additional token rewards..

Tenderize takes it a step above by offering no-lock-up periods, meaning you can use the derivatives received (TenderTokens) across other investment vehicles and earn even more. Beyond the initial staking rewards, Tenderize also enables liquidity providing and yield farming for its TenderTokens. We’ll get to those later in this guide. Let’s look at how you can start staking on Tenderize.

How to stake on Tenderize?

When you open the Tenderize app, you’ll immediately be on the staking section.

Currently, there are two tokens you can stake:

Each staking option has a different APY, meaning the total return you can expect with the compounding effect after a year. Very soon, we’ll introduce staking for Audius (AUDIO) and The Graph (GRT).

To start staking, go to the top right end corner of the page and connect your preferred wallet. Currently, you can connect your MetaMask, WalletConnect, or Coinbase Wallet.

After connecting your wallet, make sure you’re under the right network. Tenderize is currently on Ethereum Mainnet (available for GRT and MATIC tokens) and Arbitrum (available for LPT tokens).The application will show a button to switch networks in case you’re on the wrong one.

Now, you can select the amount of the tokens you want to stake. Then, you just need to click on the “Authorize Tenderize to spend” the token you selected (e.g., MATIC). After the authorization, click on “Stake,” and you’ll start earning rewards. Please be aware of gas fees when authorizing spending tokens and when staking. In the case of LPT, you don’t need to go through the “approve” step since a MetaMask popup will appear to sign a message, and then a transaction will be sent to approve the spending and staking.

- Swapping on Tenderize

Once you gain TenderTokens and start earning staking rewards, you have a few options available to expand your opportunities.

How to swap tokens on Tenderize

On the Tenderize app, you can select the “Swap” tab to convert your TenderTokens for the original deposited asset. For example, tenderLPT (LPT) for LPT.

You can easily select the balance you wish to convert and click “Trade” to conclude the transaction (please be aware of sufficient funds for gas fees).

Please note that swapping has price implications and that slippage may occur. We addressed this issue in more detail in this article under the “A note on price slippage and impermanent loss” section.

2. Providing liquidity on Tenderize

On TenderSwap, you can also put your TenderTokens for further use by providing liquidity to some pools (e.g., tLPT/LPT).

What is liquidity providing?

In a DeFi ecosystem, investors can deposit tokens in a Liquidity Pool for a particular trading pair and support the protocol in providing sufficient liquidity for buyers and sellers. By providing such liquidity, investors receive rewards from swap fees.

Once you receive your new TenderTokens from staking, you can use those tokens to provide liquidity to specific pairs (e.g., tGRT/GRT liquidity) and earn more rewards. It’s easy to do.

How to provide liquidity on Tenderize

First, select your token from the dropdown in the top left corner of the app (e.g., AUDIO, GRT, MATIC, LPT) and make sure your connected wallet is under the right network.

Then, please go to the “Swap” tab on the Tenderize app and select “Add Liquidity.”

You can now choose the amount of the original token and the amount of the TenderToken that you wish to deposit in the Liquidity Pool.

Once you’re ready, click on the “Allow Tenderize to spend token” and confirm the transaction on your wallet (be aware of gas fees).

Now, you can effectively add liquidity to the pool by clicking “Add Liquidity”. In return you will receive an amount of liquidity pool tokens (e.g. tLPT-LPT-SWAP) that represent your deposited liquidity. At any point, you also have the option to “Remove Liquidity.”

A note on price slippage and impermanent loss

Automated Market Makers (AMMs) face potential price slippage between assets and impermanent loss. When providing/removing liquidity, unbalanced token allocations can lead to price slippages. The optimal approach is to provide liquidity weighted equally on both tokens to ensure a pool’s equilibrium.

TenderSwap is a stableswap AMM solving some of the capital issues of traditional AMMs, offering higher efficiency and a smaller amount of price slippage when swapping. It provides UX benefits as well by not having to wrap elastic supply tokens for usage in liquidity pools.

3. Farming on Tenderize

Now that you received Liquidity Pool tokens from providing liquidity to the Tenderize protocol, your opportunities can expand further with yield farming.

What is yield farming?

Yield farming is another opportunity in the DeFi ecosystem to earn on top of your original holdings and on top of your derivatives (e.g., TenderTokens).

Farming consists of earning a portion of a protocol’s revenue (staking rewards) in the form of TenderTokens since you’re providing liquidity and allocating your share of SWAP tokens in the TenderFarm.

How to yield farm on Tenderize

On the Farm tab of the Tenderize app, you can farm your SWAP tokens for extra TenderToken rewards by going to the “Farm” tab.

To begin your farming experience on Tenderize, click on the “Farm” button and select the amount of SWAP tokens you wish to farm.

Once you start to receive rewards, you can farm them and earn automatically compounding TenderToken rewards which you can withdraw by clicking the “Harvest” button.

When you decide to stop farming, you can collect all (or a portion) of your original staked tokens and rewards by clicking on the “Unfarm” button.

The Tenderize flow: Grab the opportunity

Tenderize is building an end-to-end earning journey for node runners, Web 3 protocols, and crypto investors to expand their opportunities from just one token.

From an original token, you can earn staking rewards using TenderToken derivatives, provide further liquidity with both assets, and earn more rewards. For a supercharged experience, you can still farm your SWAP tokens to earn extra rewards, leading to a super cycle of returns.

With future updates, Tenderize will work towards a fully-fledged ecosystem with attractive rewards, more flexibility, and even more use-cases in the intersection of DeFi, derivatives, and Web 3.

Alpha in your inbox,

Subscribe now!

Subscribe to our newsletter and receive exclusive insights and be the first to know about new releases.

We will never spam you.